MEET DOTYPAY

Smart features.

Smart design.

Smart terminal.

The Dotypay payment terminal has the largest number of state-of-the-art systems and functions in one device, see for yourself.

Payment terminal functions

Mobile waiter

Use a mobile waiter, it has many advantages.

Multi TID

Multiple customers (ID) on one device.

Tip

Take advantage of advanced tipping options.

Variable symbol

When you need var. symbol on a receipt or statement.

Sales function

Standard sale, return, cancel last transaction, tip.

Crediting money

Credit your money every fourth day after receiving the transaction.

Any bank account

You do not need to change your bank account with us, we will send the money to any bank.

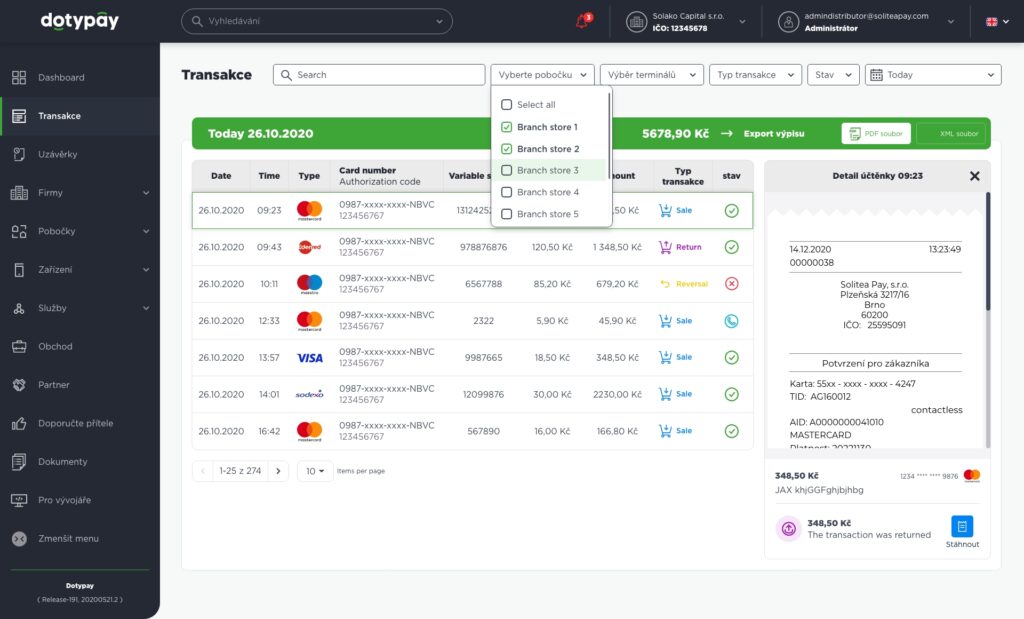

Transactions in the Cloud

View and filter all transactions anytime, anywhere online.

Advanced features

In our application, you also have several advanced functions available, such as reports and deadlines.

Language (CZ/SK/EN)

Our payment application can speak both Czech and Slovak and English.

Pre-authorization

The function serves to hold the funds on the account / card for several days.

MoTo Payments

Payments by entering card data without a payment card.

Payment methods

Accept payments anytime & anywhere

Accept not only cards, contactless payments, Apple and Google Play, but also food vouchers with a fee of only 0.60% per transaction.

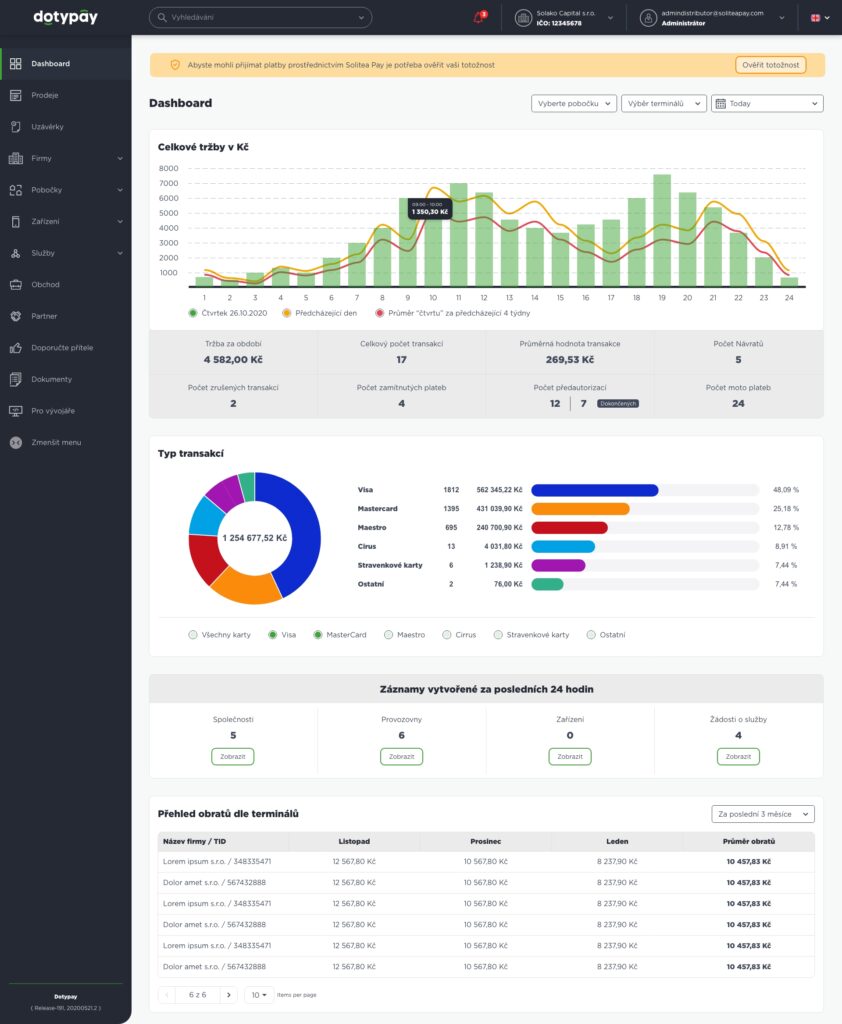

Customer portal

All clearly in one place with a free customer account

Anyone who has a payment terminal from us has a customer account maintained for FREE on our portal. Through this system, it is possible to remotely enable or disable various functions on the terminal and thus control its settings. Gradually, we will add other functions to the portal, which you will manage yourself through the portal, and especially we are preparing statements and an overview of transactions for you.

Today on our portal you can see these features:

Payment function

The portal is also used to verify your identity in order to activate the payment functions on the terminal, which are required by anti-money laundering laws. That is why the portal is equipped with a check-in function, where you write information about you and your company on an electronic form, upload your identity card to a secure storage together with a confirmation of account management, to which we will pay you funds for transactions at your terminal.

Companies and branches

An overview of your companies that use our services, including all your branches or establishments.

Statistics and analysis

We will soon enable the portal to monitor turnovers on your terminals, transactions for individual days with a detailed overview of used cards, deadlines and other statistics, which can also be downloaded in PDF or XML format. different establishments that you will be able to compare in real time or with historical data.

Terminals and services

The list of payment terminals for which you can see their identification, the list of services activated on the terminal when the terminal was last online and the version of the payment terminal system.

Technical Specifications

5.5“ Touch screen

IPS 1280x720 pixels

Safety

PCI PTS 5.0

Memory

1GB RAM, 8GB FLASH + Micro SD

Battery

Li-ion 2600 mAh x 7.2V

Connectivity

WiFi, LTE, SIM, GPS, Bluetooth, 4G, Micro USB

System

Android 5.1. payment security system

CPU

Cortex-A9 Quad-Core

Fiscal module

2xSAM

Camera

5MPX, auto flash, autofocus

Contactless

NFC Reader, IC card Reader

Thermal printer

58mm width x 40mm

Dimensions

183 x 84 x 64 mm

Applications and cash register systems

Supported cash register systems and applications directly on Dotypay devices,

which you will find in the APP Market directly on the device.

Interconnected accounting programs and cash register systems

What does interconnection mean and what are the benefits?

The superior accounting or cash register system automatically sends the amount to the device for payment, so the terminal operator does not have to overwrite the amount and thus there is less error rate but also higher speed when handling customers. After the transaction, the terminal returns information to the control system about the result of the payment transaction.

The link may also include other benefits for posting documents, in particular it may transmit additional data on the basis of which transactions are automatically posted and processed.

Higher speed

You will be able to serve all your guests quickly and clearly.

Higher profits

Thanks to quick synchronization with the cash register, the data remains in one place.

Greater customer satisfaction

Thanks to shorter order and payment times, you will get satisfied customers

You can use the touch terminal almost everywhere

Dotypay uses a modern type of payment terminal, which is also referred to as a “smart terminal”. You can use it in all cases.

On the roads

At the reception

In the market

In the car

In the office

In the shop

In the restaurant

In the city

What you will find in the package

Payment terminal

Power adapter + Micro USB

Sticker for marking the store

Accessories for the payment terminal

Stable rotating stand for Dotypay. Made of high-quality steel, it allows you to firmly hold the terminal so that you can work on it well...

50 €

The Dotypay Cloud service serves as an Internet connection for the payment terminal in the form of LTE...

2 €

For developers

Here you will find documentation for developers working with Dotypay systems.

Payment protocol – a description of the protocol on how to initiate payments on the external payment terminal.